SINGAPORE: Asian spot liquefied natural gas (LNG) prices saw gains this week as rising temperatures in the northeast part of the region led to some pick-up in demand, and as escalating geopolitical tensions in the Middle East raised concerns about supply disruptions.

The average LNG price for July delivery into north-east Asia was at $12.60 per million British thermal units (mmBtu), up from $12.30/mmBtu last week and its highest levels since early April, industry sources estimated.

The average price for August delivery was estimated at $12.70/mmBtu.

Following Israel’s attack on Iranian military and nuclear targets, Iran showed interest in taking revenge to these assaults, expanding the geopolitical premium, said Klaas Dozeman, market analyst at Brainchild Commodity Intelligence.

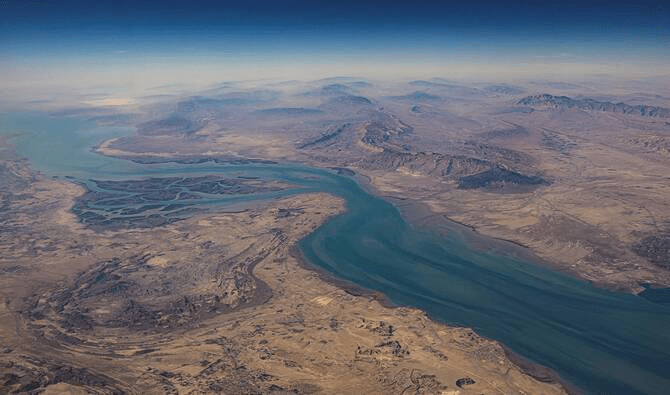

“For gas and LNG, the real risk would be to disrupt Qatar’s LNG exports for example via the Strait of Hormuz. Given earlier military threats, this still seems far away, at least for now.”

Key exporter Qatar sends almost all of its LNG through the strait.

Global LNG: Asian spot prices flat as weak demand, rising Europe supply caps gains

Meanwhile, increased South Korean appetite helped to lift prices, as well as incremental demand from Taiwan and China ahead of the cooling demand season, said Martin Senior, head of LNG pricing at Argus.

Many parts of China are experiencing above-seasonal average temperatures, which may increase gas-for-power demand through to end-June, while Japan is expecting a 70% probability for above-average temperatures until the end of the month, said Rystad Energy, citing Japan’s Meteorological Agency.

In Europe, S&P Global Commodity Insights assessed its daily North West Europe LNG Marker price benchmark for cargoes delivered in July on an ex-ship basis at $11.895/mmBtu on June 12, a $0.445/mmBtu discount to the July gas price at the Dutch TTF hub.

Spark Commodities assessed the price for July delivery at $11.815/mmBtu, while Argus assessed at $11.95/mmBtu.

“An open inter-basin arbitrage as well as strong Egyptian demand has increased competition for Atlantic basin cargoes for European buyers,” said Senior of Argus.

“One carrier diverted in the mid-Atlantic to Asia, and the vast majority of west African loadings so far this month have headed to Asia, showcasing the open arbitrage.”

Egypt has reached agreements with several energy firms and trading houses to buy 150-160 LNG cargoes to meet power demand.

Meanwhile, the U.S. arbitrage to northeast Asia via the Cape of Good Hope increased this week and is now only marginally pointing towards Europe, while the arbitrage via Panama continues pointing to Asia for a second week, said Spark Commodities analyst Qasim Afghan.

In LNG freight, Atlantic rates rose for the first time in almost six weeks to $33,000/day, while Pacific rates held steady at $20,750/day, he added.