HOUSTON: Oil prices jumped over 7% on Friday to multi-month highs after Israel launched air strikes against Iran, sparking Iranian retaliation and raising worries about a disruption in Middle East oil supplies.

Brent crude futures were up $4.94, or 7.12%, to $74.30 a barrel at 1442 GMT, after hitting an intraday high of $78.50, the strongest level since January 27.

U.S. West Texas Intermediate crude was up $4.72, or 6.94%, at $72.75, touching its highest since January 21 at $77.62 earlier in the session.

Friday’s gains were the largest intraday moves for both contracts since 2022, after Russia’s invasion of Ukraine caused a spike in energy prices.

Israel said it had targeted Iran’s nuclear facilities, ballistic missile factories and military commanders on Friday at the start of what it warned would be a prolonged operation to prevent Tehran from building an atomic weapon. Iran has promised a harsh response.

U.S. President Donald Trump urged Iran to make a deal over its nuclear programme, to put an end to the “next already planned attacks.”

The National Iranian Oil Refining and Distribution Company said oil refining and storage facilities had not been damaged and continued to operate.

Oil prices drop as traders gauge ME tensions

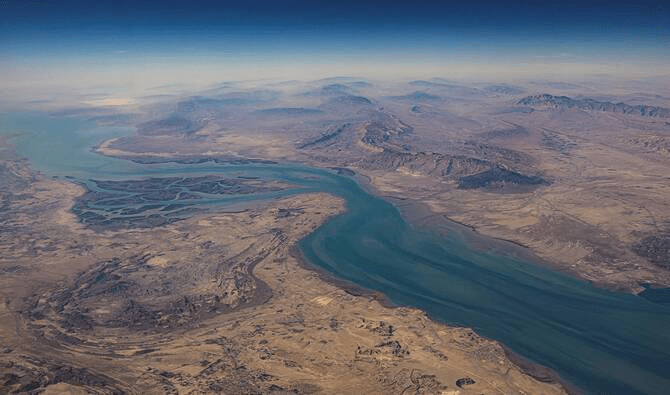

The primary concern was whether the latest developments would affect the Strait of Hormuz, said Nikos Tzabouras, senior market analyst at Tradu.com.

“Sustained upside would require actual disruptions to physical flows – such as damage to Iran’s oil infrastructure or a blockade of the Strait of Hormuz, a key global chokepoint,” Tzabouras said in a note on Friday morning.

About a fifth of the world’s total oil consumption passes through the strait, or some 18 to 19 million barrels per day (bpd) of oil, condensate and fuel.

So far, no impact to oil flow in the region has been seen, Saxo Bank analyst Ole Hansen said.

“No energy installations have been impacted by the Israeli strikes, so unless Iran decides to drag other nations, especially the U.S. into the conflict, the risk of a supply disruption remains low and should over time reduce the risk premium,” Hansen said.

Iran could pay a heavy price for blockage of the Strait of Hormuz, which it and its neighbors rely on to ship oil to Asian markets, analysts said on Friday.

“Iran’s economy heavily relies on the free passage of goods and vessels through the seaway, as its oil exports are entirely sea-based. Finally, cutting off the Strait of Hormuz would be counterproductive to Iran’s relationship with its sole oil customer, China, said Natasha Kaneva, Prateek Kedia, Lyuba Savinova, analysts with JP Morgan.

In other markets, stocks dived and there was a rush to safe havens such as gold and the U.S. dollar and Swiss franc.