NEW YORK: A United States strike on Iranian nuclear facilities is raising alarm bells in global financial markets, with experts warning of a surge in oil prices and increased volatility amid deepening geopolitical tensions.

While Gulf stock markets appeared to take the news in stride during Sunday trading—with indexes in Saudi Arabia, Qatar, and Kuwait remaining flat or slightly up—investors are bracing for a more dramatic reaction when major global markets reopen.

“This will blanket markets in uncertainty,” said Mark Spindel, Chief Investment Officer at Potomac River Capital. “Oil will likely open higher, and safe-haven assets like the dollar may see strong demand. The full damage assessment will take time.”

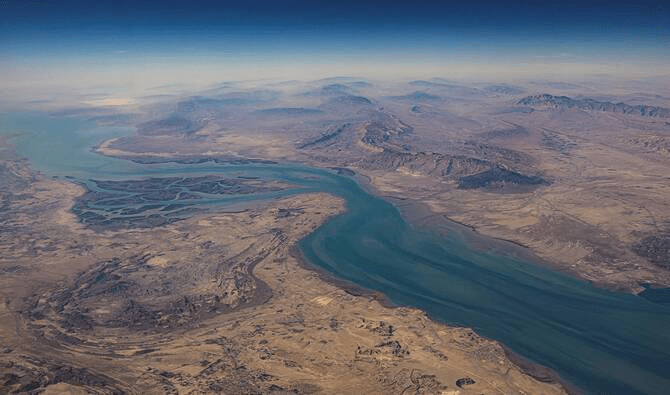

Iran has escalated its missile attacks on Israel following the US’s sudden military involvement. Analysts fear Tehran could retaliate by targeting American interests or disrupting oil flows through the Strait of Hormuz—a vital export route for Gulf oil producers.

“If Iran follows through on its threats, we could see oil shoot toward \$100 per barrel,” warned Saul Kavonic, senior energy analyst at MST Marquee.

Brent crude has already climbed 18% since June 10, reaching \$79.04 last Thursday, while the S\&P 500 has remained relatively steady. Meanwhile, retail sentiment dipped sharply, with Ether falling 8.5% on Sunday, down 13% since the Israeli strikes began on June 13.

Rising oil prices risk fueling global inflation, weakening consumer confidence, and dampening prospects for near-term interest rate cuts, economists cautioned.

By Reuters