ISLAMABAD: Saudi and Kuwaiti investors in K-Electric have launched a USD 2 billion international arbitration case against Pakistan, sharply escalating a long-running dispute involving regulatory intervention, unpaid government dues and the prolonged blockage of a USD 1.77 billion sale of the country’s largest private power utility.

The arbitration was initiated on January 16, 2026, when London-based law firms Steptoe International (UK) LLP and Omnia Strategy LLP, acting on behalf of the investors, submitted a Notice of Arbitration under the OIC Investment Agreement and the UNCITRAL Arbitration Rules, formally naming the Islamic Republic of Pakistan as the respondent.

The claimants comprise 32 Saudi individuals and entities linked to the Al-Jomaih family and five Kuwaiti companies, which together hold an indirect 30.7 percent stake in K-Electric. They have been cornerstone shareholders since the utility’s privatisation in 2005, Pakistan’s first major power-sector divestment.

The investors have appointed Professor Stephan Schill as their arbitrator and proposed the Permanent Court of Arbitration to administer the case. Pakistan now has 60 days to nominate its arbitrator.

According to the 39-page Notice of Arbitration, the investors claim to have invested more than USD 4.7 billion in Karachi’s power infrastructure over the past two decades, transforming a loss-making state utility by reducing technical and commercial losses and expanding generation and distribution capacity. They state that no dividends were ever taken, with all profits reinvested, and estimate savings of over USD 3 billion for the Pakistani exchequer.

The dispute dates back to October 2016, when the investors agreed to sell 66.4 percent of K-Electric to Shanghai Electric Power Company in a USD 1.77 billion transaction. Although initially backed by relevant ministries and regulators, the deal remained stalled for more than eight years due to what the investors describe as shifting regulatory conditions, conflicting official directives and the failure to grant mandatory national security and other approvals. The prolonged delays ultimately led Shanghai Electric to withdraw, depriving the investors of their exit and, they argue, amounting to indirect expropriation under international law.

The arbitration also highlights long-standing unpaid government receivables, including tariff differential subsidies and other undisputed dues owed to K-Electric, some outstanding for nearly two decades. The investors contend that these arrears severely constrained cash flows, while government entities continued to impose late-payment penalties.

Attempts at an amicable resolution also failed. Following the formation of a high-level task force in 2022, a cabinet-approved mediation process was launched in February 2024. Although the mediator reportedly completed findings in May 2025, the process ended abruptly before a final determination, with the investors alleging state interference.

The filing further accuses the government of politicising K-Electric’s multi-year tariff framework and undermining the independence of power regulator NEPRA. After NEPRA issued final tariff determinations in May 2025, the investors allege the government declined to notify them, reopened settled matters through flawed review proceedings and imposed revised tariffs described as confiscatory. They estimate the changes would cost K-Electric around Rs 85 billion annually, eroding the utility’s economic viability.

Additional allegations include the failure of Pakistani authorities to protect the investment from attempts by a domestic investor to seize control of K-Electric through offshore structures and regulatory violations, as well as the alleged diversion of around USD 66 million from the sale of shares in Cnergyico, a Pakistan Stock Exchange-listed company.

The investors contend that Pakistan has breached multiple provisions of the OIC Investment Agreement, including protections against expropriation, fair and equitable treatment, free transfer of funds and access to effective remedies. They have also invoked most-favoured-nation clauses to rely on protections contained in Pakistan’s bilateral investment treaties with Bahrain and Switzerland.

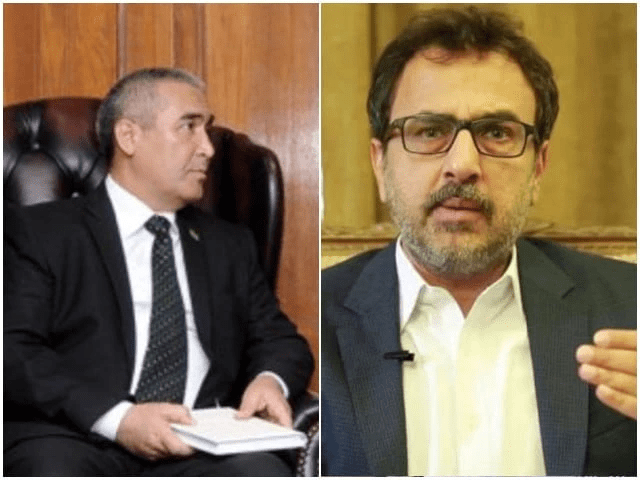

Story by Khalid Mustafa