ISLAMABAD: The Oil and Gas Regulatory Authority (Ogra) on Thursday faced strong objections during a public hearing on applications for gas marketing and distribution licences, with stakeholders questioning the reliance on uncertain future gas discoveries and non-binding supply deals. Interveners argued that many applications were based on memoranda of understanding (MoUs) with exploration companies rather than firm supply commitments, which contravenes Ogra’s licensing framework. Concerns were raised against Alhaj Group, Dewan Petroleum, Ghani Oil and Gas, and Metro Gas, whose proposed supply arrangements were either off-spec, already allocated to Sui…

Read MoreAuthor: Admin

ECC Approves \$7.7bn Financing Package for Reko Diq Project, Rail Link

ISLAMABAD: The government has approved definitive agreements and financial commitments worth \$7.723 billion for Phase-I of the Reko Diq Copper-Gold Project, paving the way for formal signing within two weeks. The Economic Coordination Committee (ECC), chaired by Finance Minister Muhammad Aurangzeb, endorsed agreements between state-owned entities, the Balochistan government, and lenders to operationalise Pakistan’s largest mining venture. The revised cost reflects a 14% increase from the March estimate of \$6.765bn, mainly due to higher debt servicing and cost contingencies. The project’s financing debt has been raised to \$3.5bn, with shareholders’…

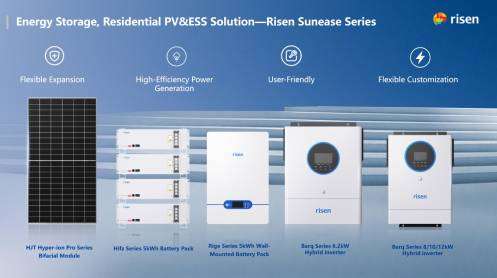

Read MoreRisen Energy Showcases Sunease Series Residential PV&ESS Solution at IEEEP 2025

Karachi – Risen Energy made a strong presence at the IEEEP 2025 exhibition in Karachi (September 16–18), where the company showcased its latest energy solutions to industry professionals and visitors. At the exhibition, Risen Energy highlighted its all-in-one solar + storage kits ( Sunease Series Residential PV&ESS Solution) tailored for the Pakistani market. By integrating high-efficiency PV modules, hybrid inverters, and scalable Hifz battery packs, the kits provide a complete solution covering generation, storage, and smart consumption. Designed to address Pakistan’s unique challenges—such as frequent power cuts, high diesel costs,…

Read MorePakistan’s Mining Sector Can Grow From $2 Billion to $8 Billion by 2030: Shamsuddin Shaikh

KARACHI: Pakistan’s mining sector is on the cusp of transformation, with annual revenues projected to grow from the current $2 billion to $6–8 billion by 2030, if the country seizes the opportunity to tap its vast reserves. This was the central message delivered by Shamsuddin A. Shaikh, CEO of National Resources Limited (NRL), in his keynote address at the Natural Resources & Energy Summit 2025, held at the Pearl Continental Hotel, Karachi. “Pakistan’s mining sector contributes barely 0.15 percent of global mineral output and just 2–3 percent of national GDP,…

Read MoreRegulator Must Vigilantly Safeguard Petroleum Sector’s Sustainability, Says Minister Petroleum Ali Pervaiz Malik

Islamabad, September 18, 2025 — Federal Minister for Petroleum, Ali Pervaiz Malik, visited the Oil and Gas Regulatory Authority (OGRA) headquarters today, where Chairman Masroor Khan and senior officials warmly welcomed him. During the visit, Minister Malik was briefed on OGRA’s mandate, regulatory duties, and recent initiatives such as refinery upgrades to Euro-V standards, LNG virtual pipelines, safety campaigns, digitization of the oil supply chain, and establishment of one-window facilitation and regional offices. He emphasized that digitization is critical to closing loopholes, boosting transparency, and enabling effective monitoring of sector…

Read More