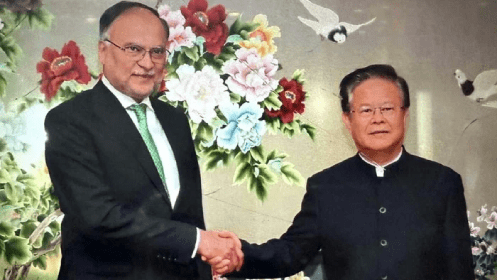

Payment issue with Chinese IPPs remains unresolved; focus shifts to industrialisation, ML-1, and Gwadar development ISLAMABAD: The 14th Joint Cooperation Committee (JCC) meeting of the China-Pakistan Economic Corridor (CPEC) concluded in Beijing on Friday, ushering in Phase-II of the landmark initiative with a comprehensive roadmap for the next decade. However, the long-standing issue of capacity payments to Chinese Independent Power Producers (IPPs) remained unresolved, as Islamabad sought an extension in repayment timelines. Federal Minister for Planning Ahsan Iqbal, in his closing remarks, hailed CPEC Phase-II as a “corridor of industrialisation,…

Read MoreCategory: Popular News

PAC Panel Warns PSO to Clear Rs150m Dues to SWO or Face FIA/NAB Action

ISLAMABAD: The management of Pakistan State Oil (PSO) has been given four weeks to settle a Rs150 million liability with the Staff Welfare Organization (SWO), failing which the matter will be referred to the Federal Investigation Agency (FIA) or the National Accountability Bureau (NAB) for recovery. The ultimatum came on Friday during a meeting of the Public Accounts Committee’s (PAC) sub-committee, chaired by Tariq Fazal Chaudhry, which was reviewing audit reports of the Establishment Division for fiscal years 2003-04 and 2008-09. The dispute revolves around a 14,256 sq. ft. SWO-owned…

Read MoreDenmark to Launch 3-Year Strategic Energy Cooperation in Pakistan from January 2026

ISLAMABAD: Denmark is set to roll out a three-year Strategic Sector Cooperation (SSC) programme in Pakistan’s energy sector from January 2026, focused on low-carbon development, cost-efficient NDC implementation, and expanding renewable energy integration. In a letter to the Power Division, Danish Chargé d’Affaires to Pakistan, Peter Emil Nielsen, lauded the Division’s support in hosting the high-level Danish Energy Agency (DEA) delegation on August 18, 2025, which kick-started preparations for the SSC covering 2026–2028. During the five-day mission, the DEA and Danish Embassy engaged with ministers, government partners, energy companies, NGOs,…

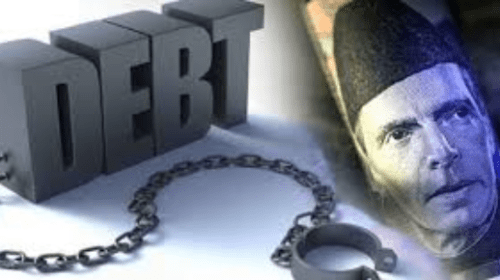

Read MoreDebt Burden Soars: Every Pakistani Now Owes Rs318,252

ISLAMABAD: Pakistan’s debt burden has reached alarming levels, with every citizen now owing Rs318,252, according to fresh estimates released by the Economic Policy & Business Development (EPBD) Think Tank. The figures reveal a sharp rise over the past decade — per capita debt has surged from Rs90,047 in 2014 to Rs318,252 in 2024, reflecting an average annual increase of 13 percent. Pakistan’s public debt-to-GDP ratio currently stands at 70.2 percent, far exceeding the legal ceiling of 60 percent set under the Fiscal Responsibility and Debt Limitation Act, 2005. In regional…

Read MoreAPTMA Urges Nepra to Reject IGCEP 2025–35 in Current Form, Calls for Robust Demand Forecasting

ISLAMABAD: The All Pakistan Textile Mills Association (APTMA) has strongly opposed the approval of the Indicative Generation Capacity Expansion Plan (IGCEP) 2025–2035 in its current form, warning that flawed demand forecasts could worsen Pakistan’s power sector crisis and further burden consumers with unaffordable tariffs. In a letter to the Nepra Registrar, APTMA Secretary General Shahid Sattar criticized the IGCEP’s demand forecasting methodology, describing it as “fundamentally flawed” and “upward-biased by design.” He urged the regulator to commission a dedicated team of international and national economists and statisticians to build a…

Read More