The U.S. power sector’s rush to build out natural gas capacity risks far more than locking in emissions that would bust the Paris climate targets – it also poses tens of billions in financial risk to utility investors.

Once commonly considered a “bridge fuel,” electric utilities now must face the mathematical reality that fast-falling clean energy costs mean the bridge only leads to climate breakdown and the destruction of shareholder value.

A new report from Energy Innovation and shareholder advocacy group As You Sow outlines these evolving risks for shareholders, strategies for investors to accelerate decarbonization, and policies for utilities to cut financial risk from over-reliance on natural gas through new clean energy investment.

The Utility Sector’s Misguided Rush to Gas

Utility investment in new natural gas infrastructure makes less and less sense from multiple angles and only compounds risks for investors, consumers, and society. New natural gas infrastructure is incompatible with a low-emissions future and faces intense economic competition from wind, solar, storage, and clean energy technologies. A clean energy transition is increasingly the more affordable, less risky option.Today In: Energy

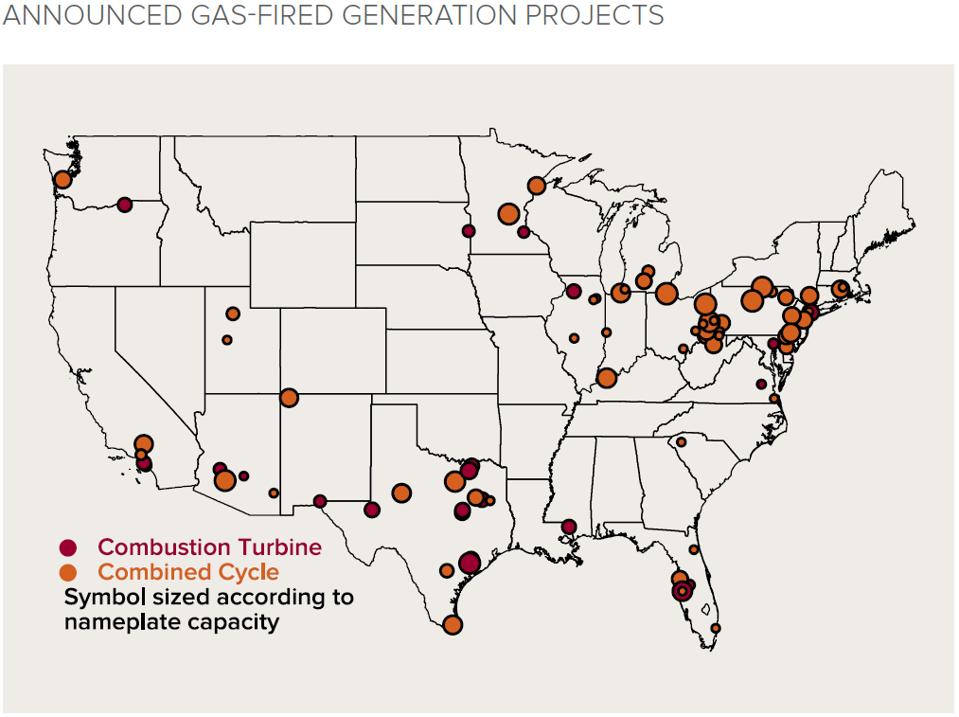

Yet utilities are poised to invest billions of dollars in new natural gas infrastructure throughout the country. Rocky Mountain Institute research found that the U.S. is on track to spend roughly $1 trillion on new gas-fired power plants and fuel by 2030, including 68 gigawatts of new capacity (more than a 15% increase).

PROMOTED

This rush to gas threatens shareholder value including investor portfolio risk, company-level physical risk, regulatory and technological transition risk, and reputational risk. While an increasing number of utilities are setting decarbonization targets aligned with the Paris Agreement’s goals, the power sector’s plans for natural gas infrastructure expansion may also jeopardize investor goals.

Physical and Portfolio Risks of Climate Change

As of June 2019, 215 of the largest global companies had reported almost $1 trillion at risk from climate impacts, much of that within five years. Power sector decarbonization is an imperative for investors to protect their portfolio value in the medium to long term, but utilities that lag behind in reducing greenhouse gas emissions are increasing the risk of catastrophic climate impacts that threaten shareholder value.

According to BlackRock, utilities themselves face significant physical risks from a changing climate, impacting investor expectations for the sector. Physical risks expose utilities to operational disruptions including storm damage due to flooding or hurricanes, fires, increased water scarcity (imperative for generation cooling systems), and legal liability.

Pacific Gas and Electric embodied this risk when it entered into bankruptcy after being held liable for destructive fires caused when its equipment ignited drought-depleted vegetation in California, an event deemed “the first climate-change bankruptcy.”

Unless sufficient action is taken to reduce climate stress, these types of challenges will only increase for companies.

State and Local Policy Risk

The shifting policy landscape and increasing public attention on climate change is rapidly disrupting natural gas infrastructure investments. Meanwhile increased awareness, activism, and grassroots mobilization are bringing climate change to the fore of public attention and increasing pressure on policymakers and companies to urgently and decisively cut emissions.

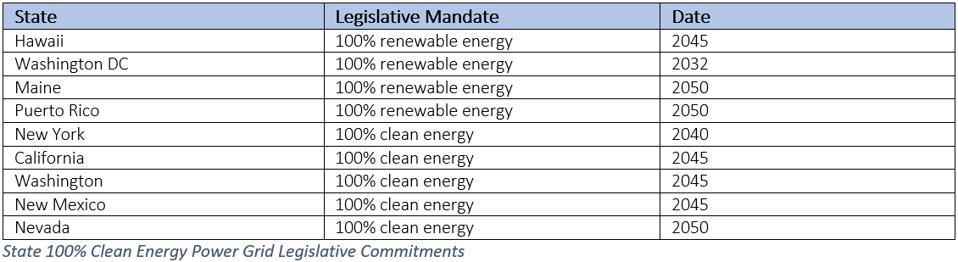

This pressure has swelled a growing tide of ambitious state clean energy commitments, as well as legislation specifically focused on curbing the use of natural gas. A growing number of U.S. states have set 100% decarbonization goals for their power grids, supercharging the clean energy transition. Several states have adopted various clean or renewable energy commitments and several governors elected in 2018 are pushing ambitious clean energy targets.

In addition to state-level goals, more than 130 cities have committed to 100% clean energy in their power grids, and six are already powered by 100% renewable generation. Meanwhile, a wave of legislation incentivizing a transition away from natural gas use in buildings has been adopted by more than 20 cities in the past year, with many more considering similar legislation.

As cities and states aim to meet climate targets, these regulatory and policy shifts are already threatening the value of utility gas assets. In 2018, NRG announced that it would close three gas-fired power plants due to regulations and, soon after, Calpine cancelled plans for a gas plant in California.

Greater scrutiny of fossil fuel infrastructure at the regulatory commission level also looms large. Financial and climate concerns have recently led several local commissions to reject utility plans for new gas power plants including Indiana, Arizona, and California. These actions point toward a future where demand for gas is limited, and are important investment signals for utilities.

Technology and Financial Risk

But financial risk from the rush to build new natural gas isn’t only driven by regulation. The cost-competitiveness of clean energy alternatives further undermines the natural gas ‘bridge’ as clean technology provides portfolios of reliable energy generation for the grid and foregoes the need for fuel, helping lower customer costs.

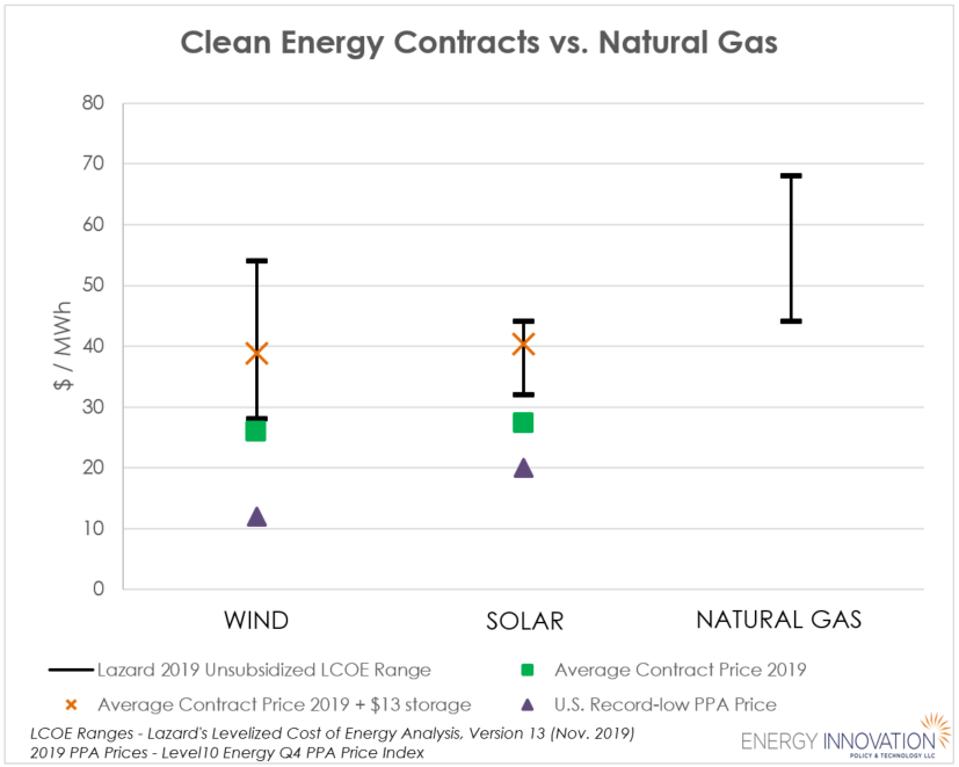

Today, new unsubsidized wind costs $28-54/megawatt-hour (MWh), and solar costs $32-44/MWh, while new combined cycle natural gas costs $44-68/MWh. In short, in almost all jurisdictions, utility-scale wind and solar are now the cheapest source of new electricity without subsidies.

While comparing the levelized cost of energy (LCOE) only tells part of the story, the economics for clean energy resources stand out when utilities compare portfolios of clean energy resources that provide the same energy adequacy of new natural gas plants.

For example, NV Energy’s recent procurement of 1,200 megawatts (MW) solar and 580 MW of four-hour battery storage already beats new natural gas on price. NV Energy paid $20/MWh for solar and $13/MWh for enough battery storage to shift 25% of daily energy, resulting in a total cost of $33/MWh per MWh delivered (including federal tax credits).

These improved economics create new opportunities for clean generation investment to replace emissions-heavy and economically inefficient fossil power plants. They also argue for clean energy resources as the default for new power plant development. Investing in new renewables is the best way to grow shareholder returns while avoiding upward rate pressure for customers – a win-win for shareholders.

Utility Transition Risks – Into the Unknown

Though clean alternatives are very affordable, they are not without challenges. While often cited as the clean energy transition’s largest barrier, it is increasingly clear new natural gas won’t be needed to ensure grid reliability.

Studies by the National Renewable Energy Laboratory, National Oceanic and Atmospheric Administration, Evolved Energy, and Vibrant Clean Energy have found that 80% or more of our electricity could be produced from renewable sources without reliability or affordability issues. Regions of the U.S. grid already integrate renewable generation approaching these levels at certain times of the year.

Regulation and markets must also evolve to support utilities through the transition by promoting innovation. Policymakers must carefully consider the need for a just transition for workers, the development of new utility business models for demand-side management, unlocking financial tools like securitization to deal with potentially stranded investment, the misalignment of hybrid gas and electric parent-company goals with all-electric subsidiaries, and the inertia holding back a traditionally risk-averse industry.

Avoiding the rush to new gas also creates opportunities for electric utilities to become engines for decarbonizing buildings and vehicles through electrification. Southern California Edison is proactively modeling a low-carbon pathway and driving vehicle and building electrification efforts. Rather than continuing to rationalize gas investments, utilities can become decarbonization advocates at their legislatures and utility commissions, providing leadership to other stakeholders on how to decarbonize all sectors at speed and scale.

So What’s an Investor to Do?

Investors have a unique role to play in the clean energy transition because they are well positioned to encourage power utilities to reduce investment risks associated with over-reliance on natural gas and avoid early retirement challenges that coal plants now experience across the country.

The Energy Innovation and As You Sow report outlines how investors can play their part:

- Engaging directly with companies to request analysis of emerging risks regarding natural gas investments including stranded asset risks.

- Joining influential investor coalitions such as Climate Action 100+ and Climate Majority Project, following major investors like BlackRock.

- Shifting the policies and regulations governing utility operations to encourage a clean energy transition. For example, advocating for innovative policies such as securitization, performance-based regulation, and net-zero goals with utilities, regulators, policymakers, and in public forums in the energy industry.

Investors and the utilities they own face an urgent challenge –address the investor, consumer, and social risks of continued natural gas reliance. New investor and policymaker engagement are required to build an off-ramp from the bridge to climate breakdown.