Oil and Gas Development Company Limited (PSX: OGDC) is the largest player in the E&P sector in the country. It has the largest portfolio of net hydrocarbon reserves in Pakistan, which includes 44 percent of oil and 37 percent of gas as of June 2020. The company contributed to 29 percent of Pakistan’s total natural gas production, and 46 percent of its oil production in FY20.

Shareholding Pattern

Government of Pakistan is the largest shareholder in OGDC. Its disinvested part of its shareholding in the company back in 2003. Initially 2.5 percent of the equity with an additional green-shoe option offered to the public. Then in December 2006, the government divested a further 10 percent of its holding in the company. The breakup of the latest shareholding is given in the illustration.

OGDC recent performance

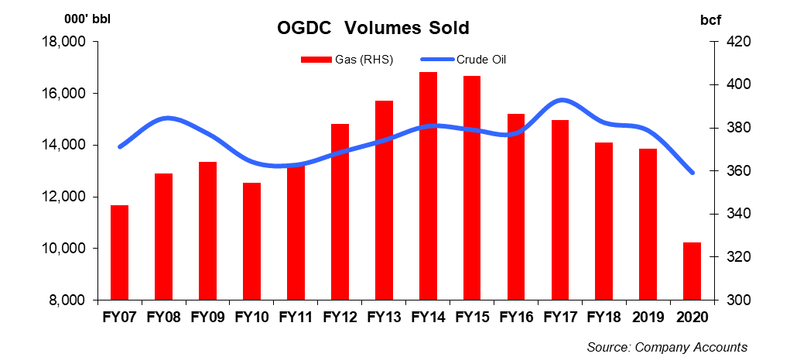

Being the leading oil and gas E&P company, OGDC stay ahead with its & exploration and drilling activities despite the natural decline in the reserves, discoveries, and hence crude oil and gas production. A look at the OGDC’s last three-year performance shows that while the company has been aggressive in its drilling activities as well as in acquiring seismic data, production of hydrocarbons has been on a downward trend. gas production particularly has been falling due to natural depletion in the mature fields.

However, when compared to FY13, the annual report for FY18 gives some indicators of improvement such as higher 2D and 3D seismic survey acquired; continued and sustainable drilling activity where the average number of exploratory/appraisal and development wells have remained constant; better crude oil, LPG and sulphur quantities sold over the years etc. But when looking at the financials, sales revenue and earnings show a decline not only due to weaker production stats but also lower oil prices that resulted in lower realised prices of oil and natural gas.

However, year-on-year performance of the E&P company was better due modest recovery in the price of crude oil. Plus, higher LPG production complemented by favourable exchange rate and planned capital spending contributed positively to the financial growth in FY18. Also, OGDC made 4 new oil and gas discoveries.

Here again, net earnings were affected due to increase in operating expenses, depreciation on account of capitalisation of assets and amortization of development and production assets on account of capitalisation of new wells and change in reserves estimates and higher cost of dry and abandoned wells owing to 11 wells declared dry and abandoned in FY18 against 4 wells in FY17 negatively affected the financial results.

FY19 was a profitable year for OGDC where net earnings increased by 50 percent year-on-year. This resulted from an increase in sales revenue by 57 percent year-on-year in FY19 due to increase in average net realised prices of crude oil and natural gas as well as flattish growth in the hydrocarbon production; crude oil production increase by 1.1 percent year-on-year, while natural gas production increased by 0.8 percent year-on-year. 16 wells were spud, comprising of 9 exploratory/appraisal and 7 development wells. OGDC’s exploratory efforts yielded 3new oil and gas discoveries.

FY20 was smeared by the beginning of COVID-19 pandemic. It was also a slow year for the oil and gas exploration and production sector where crashing oil prices along with COVID-19 had key impact on the sector’s financial performance. OGDC saw its bottomline being impacted as FY20 earnings slipped by 15 percent year-on-year, where most of the decline came from 2HFY20.