The growing threat of a Russian invasion of Ukraine had the energy market on edge Monday, when oil and natural gas prices again moved higher.

The standoff has also upended metals markets, weighed on equities and is creating additional inflationary pressures. The U.S. warned Friday that an attack could be imminent, sending commodity prices up.

German Chancellor Olaf Scholz was scheduled to speak with Russian President Vladimir Putin in Moscow on Tuesday in the latest diplomatic push to ease tensions. Spot liquefied natural gas (LNG) prices in Asia followed European natural gas benchmarks higher Monday as concerns over supply disruptions continued.

“Two big topics currently dominate the market, very mild weather forecasts for large parts of the continent and the fears of a Russian invasion of Ukraine and the consequences this could have for gas supply,” said trading firm Energi Danmark in a Monday note. “These two factors to some extent offset each other, but the upside was strengthened by new nuclear concerns in France.”

Indeed, natural gas prices in Europe found further support from low nuclear availability in France, a major electricity exporter. Électricité de France SA has taken three reactors offline and extended the outage of another for maintenance, limiting availability to just 75% of capacity. Rystad Energy analyst Kaushal Ramesh said the move has “jolted some nerves” in the market “as this signals a bullish call on gas-fired power as back up.”

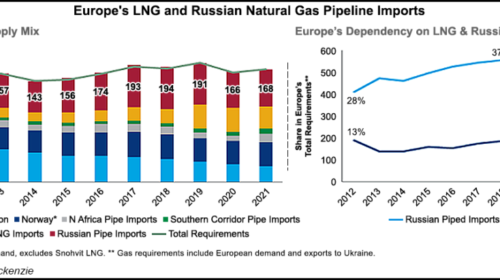

European storage inventories are at about 34% of capacity, compared to the five-year average for this time of year of 46%. Prices jumped across the curve Monday following a tense weekend in the standoff between Russia and Ukraine. Julien Hoarau, head of Engie EnergyScan, told NGI that any cut in Russian supplies to Europe could be impactful. He added that LNG supplies would not be enough to offset a complete cut in Russian pipeline deliveries to the continent, which remains unlikely.

“At the opposite, the absence of a disruption in Russian gas flows to Europe could cut the risk premium in European gas prices,” Hoarau added.

Mild weather and an influx of LNG cargoes weighed down European gas prices last week. LNG imports on the continent broke records last month. Rystad said arrivals remain strong with 3 million metric tons delivered so far in February, putting the continent on track to take in more than 7.5 million metric tons through the end of the month.

Even still, the trend in forward prices suggests Europe will remain the market of choice for flexible LNG cargoes in February and March, EnergyScan analysts said Friday. But colder weather is forecast for North Asia over the next two weeks that could increase withdrawals there and create additional competition with Europe for cargoes as the spring restocking season also nears.

“There is considerable discomfort in the falling inventory levels that have sent some buyers back to the spot market to procure alternative supplies,” Ramesh said.

Oil prices were also testing new levels. Brent crude for April delivery surged above $96/bbl on Monday for the first time in seven years.

In the United States, meanwhile, international demand for LNG remains strong. Feed gas deliveries to U.S. terminals surged to records above 13 Bcf over the weekend. Volumes have continued ramping up at the Calcasieu Pass terminal in Louisiana, which was cleared by federal regulators last week to load its first commissioning cargo. The Greece-flagged vessel, Yiannis, was still moored Monday afternoon at Venture Global LNG Inc.’s Calcasieu Pass terminal waiting to load.

Cheniere Energy Inc. also said last week that its sixth train at the Sabine Pass terminal in Louisiana has entered commercial service.

Despite soaring international demand, Henry Hub prices have remained subdued on milder weather in the United States. The contract fell by nearly 14% last week. But March prices were back up Monday, closing above $4/MMBtu as the European weather model showed chillier temperatures moving into the northern part of the Lower 48 next week.