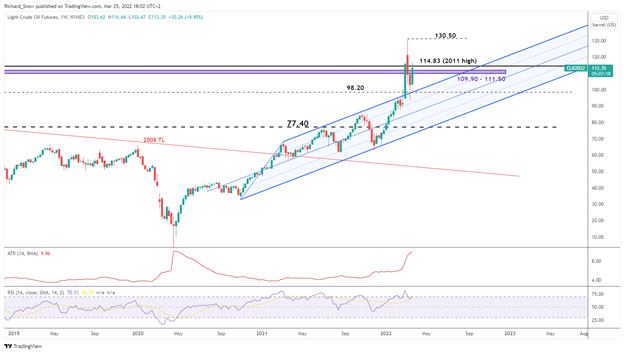

In Q1,crude oil prices continued the long-term bullish trend that began after WTI futures briefly spiked into negative territory in 2020. The US benchmark traded within a neat pitchforkthroughout 2021, registering multiple bounces within its confines.The invasion of Ukraine ultimately sent oil prices into a parabolic rise, however.

After reaching a high of 130.50, WTI pulled back sharply towards the pitchfork before attempting another advance. The 2011 high at 114.83 has proven to be the next level of resistance. Price action has stalled there twice in the last four weeks.

At the time of writing (25 March 2022), WTI crude oil is on track to end the month higher even as prices trade midway between the monthly open and high.

Technically, the trend bias remains constructive given the absence of sequentially lower highs and lows. That prices remain at similar levels observed before the invasion of Ukraine seems to signal sustained bullish intent. Finally, the weekly RSI has receded from overbought territory, which may help clear the way for bullish continuation.

If WTI ends Q1 above the 109.90 – 111.50support zone, a retest of 130.50 remains the target. There is a nearby level of resistance at 114.83 which would need to be overcome, but little else stands in the way. The trade is invalidated should WTI trade below the March monthly low of 93.90.

WTI CRUDE OIL WEEKLY CHART

Chart prepared by Richard Snow, TradingView

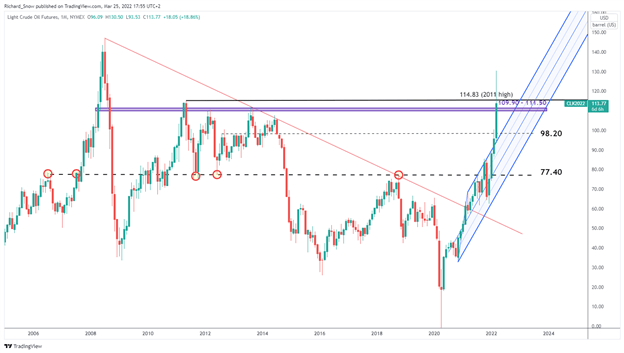

There are a number of levels and zones warranting careful consideration and zooming out to the monthly chart helps gain an appreciation for them. The level of support not yet covered is 98.20 – a level that kept prices at bay throughout 2012/2013. The bullish bias remains constructive even if prices drop to this level in early Q2.

WTI CRUDE OIL MONTHLY CHART

Chart prepared by Richard Snow, TradingView