The China PV Industry Association (CPIA) recently hosted a virtual seminar on the industry’s growth in the first half of 2022 and the outlook for the second half of the year. Dr. Max Li, Senior Product Manager at LONGi, spoke on the technical advancement of crystalline silicon PV cells and modules, with an emphasis on efficiency, cost reduction, power generation performance and size optimization.

According to Bohua Wang, Honorary Chairman of the CPIA, the market share for large-size silicon wafers has increased rapidly, owing to the growing demand for large-format modules, scenarios where they can be applied and cost reduction due to technological progress, developments which have already convinced a number of companies to dedicate all their production lines to M10 and G12 products. Wang’s view was supported by official statistics related to China’s state-owned module bidding, which indicated that M10 modules had accounted for 81% of total winning bids during the period from January to May, establishing themselves as a market mainstream. M6 modules accounted for only 8.1% of the market, with those offering power below 400W increasingly disappearing.

In terms of production capacity, the CPIA reported that China’s module production reached 94GW between January and May, with the manufacturing capacity of some leading companies exceeding 50GW, with the potential to reach 80GW.

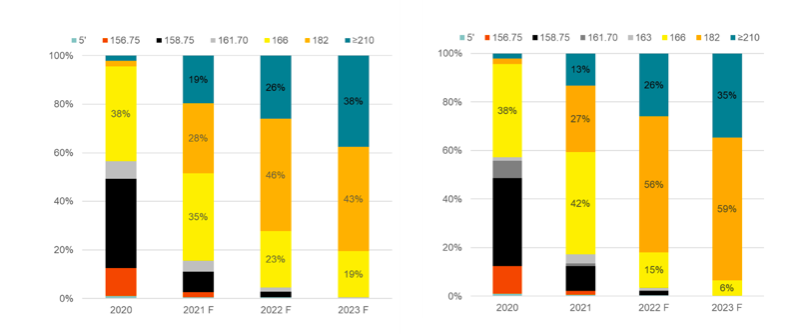

As for module shipments, PV InfoLink has published data related to the market share for different wafer sizes in the second quarter of 2022, the high uptake of M10 products in comparison to other sizes being clear. M10 accounted for 27% in 2021, with global shipments of around 48.5GW, with G12 products holding a 13% market share, with shipments totalling 23.5GW.

The organisation has also made major adjustments to its shipment forecasts for 2022, the market share for M10 products predicted to increase significantly to 56%, with that for G12 forecast to decrease to 26%.

Third-party analysts had previously believed that manufacturing determines size, based simply on the capacity of cell production lines and the linear extrapolation of continual size increases over recent years, resulting in deviations between prediction and reality. In fact, size is determined by product value. M10 products were well received by clients in 2021 due to their superior overall performance, with a significant quantity of G12 wafer and cell capacity now converted to M10, as has also been the case with M6 capacity.

The M10 specification was developed from a PV industry application standpoint, and it has proven successful in terms of product reliability, manufacturing, packaging, installation, system design and electrical safety. Meanwhile, the high shipping costs experienced in 2021 have also served to underline the advantages of M10 modules, further squeezing the share of M6 in the DG market.

M10 cells offer high efficiency and manufacturing yield in the PERC era. This advantage will be more evident over the long term with the advent of new, even higher efficiency cells, the M10 specification of 182mm having already been selected by a number of key players for their new products.

With the global market share for M10 now exceeding 50%, and with standardization on module size, its advantages within the industry chain will become clearer and its market share expanded more rapidly.