oughly a three-hour drive south of Perth, Western Australia, off the South Western Highway and behind the historic mining town of Greenbushes, the land beyond the town’s primary school falls away to reveal a deep, grey scar.

This is the site of an old tin mine known as the Cornwall Pit. At roughly 265m (870ft) deep, the terraced wall of the pit represents a century’s worth of work that began in 1888 when a pound of tin was lifted out of a nearby creek. When the surface-metal was scoured from the landscape, methods changed eventually giving way to open-cut mining in the host pegmatite vein – an igneous rock with a coarse texture similar to granite.

In 1980, another metal was found at Greenbushes which, at the time, didn’t give the mine owners much pause for thought. Lithium, a soft, silvery-white reactive alkali metal, was considered more of a geological oddity.

A small-scale mining operation began in 1983, extracting lithium for use in niche industrial operations like glass making, steel, castings, ceramics, lubricants and metal alloys. It wasn’t until decades later when the existential risk posed by climate change became widely understood, and governments began talking about replacing the estimated 1.45 billion petrol cars worldwide with electric vehicles, that the reserves at Greenbushes began to be seen in a very different light.

Today the Cornwall tin pit is closed for business, and Greenbushes has become the largest lithium mine in the world.

Demand for lithium could grow to more than 40 times current levels if the world is to meet its Paris Agreement goals

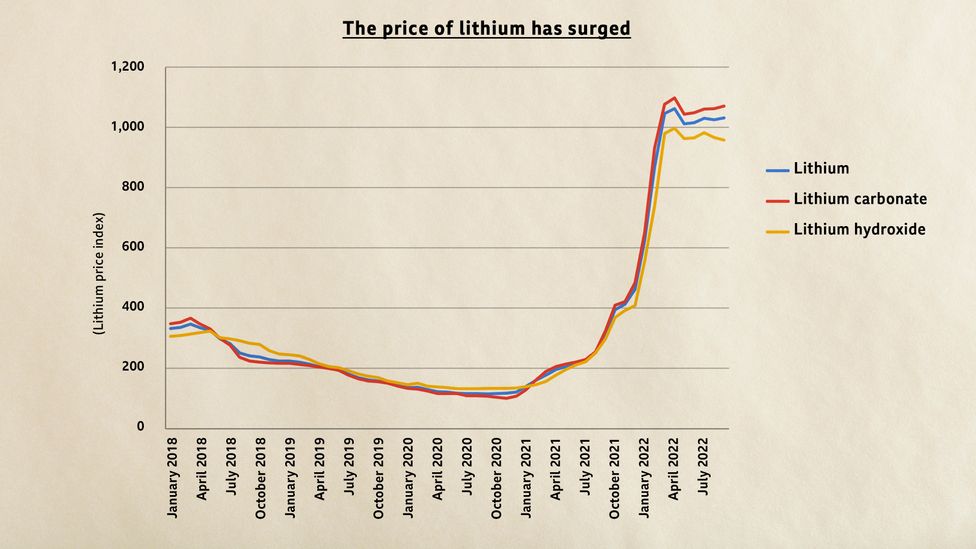

In less than two years, prices for Australian spodumene – a lithium-rich raw material that can be refined for use in laptop, phone and EV batteries – has grown more than tenfold. According to Benchmark Mineral Intelligence, spodumene sold for $4,994 (£4,300) a tonne in October 2022, up from $415 (£360) in January 2021. By 2040 the International Energy Agency expects demand for lithium to grow more than 40 times current levels if the world is to meet its Paris Agreement goals.

This has sparked claims of a new lithium-rush and Australia has positioned itself to be the world’s go-to supplier. Which begs the question, as the world reaches for this metal in an attempt to help with decarbonisation – how sustainable is lithium mining?

You might also like:

- What would happen if the world stopped mining?

- Lithium batteries’ big unanswered question

- The environmental case for buying a coal mine

In 2021, the lithium mined at Greenbushes alone accounted for more than a fifth of global production – and it is expected to grow. In 2019 the mine’s owners Talison Lithium received permission to double the site’s size in an A$1.9bn ($1.2bn/£1.1bn) expansion that, when complete, will cover an area 2.6km (1.6 miles) long, 1km (0.6 miles) wide and 455m (1,490ft) deep. At 310m (1,020ft) high, the tallest building in London, The Shard, could be comfortably buried inside.

While Greenbushes is Australia’s largest lithium mine, contributing 40% of the 55,000 tonnes of lithium mined in the country in 2021, there are several others close behind. In total, there are four other hard-rock lithium operations in Western Australia’s legacy mining regions around Kalgoorlie in the east and the Pilbara in the state’s far north. A sixth – the only lithium mine outside Western Australia – is an open-cut mine near Darwin in the Northern Territory, which began operation in early October 2022. Two other mines are in planning with other proposals at various stages of development.

Spodumene is a rich source of lithium, which can be refined for use in batteries (Credit: Getty Images)

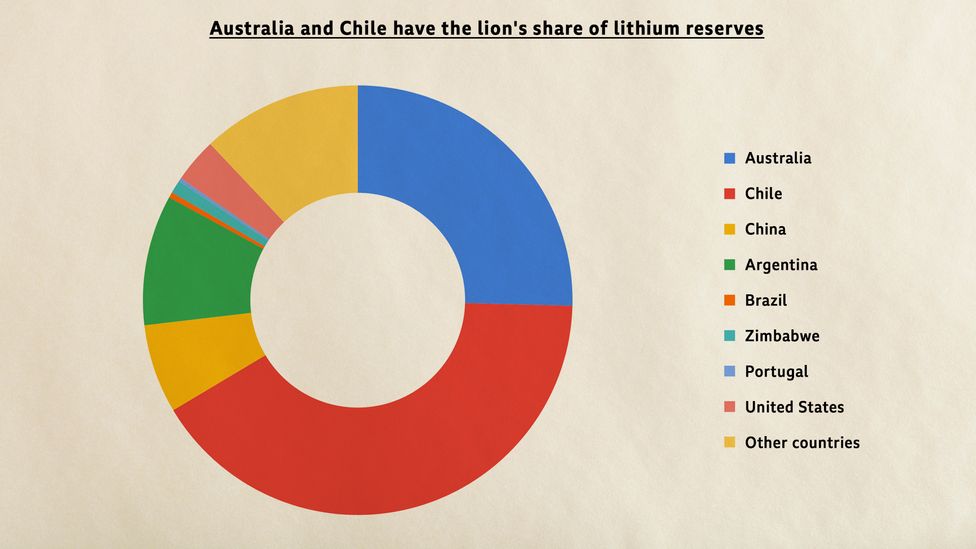

Their combined output allowed Australia to supply roughly half the world’s lithium in 2021. Its next biggest suppliers are Chile and China, which both draw their lithium from brine pits. Over the next few years this is expected to change as the countries in South America’s “lithium triangle” – Chile, Argentina and Bolivia, which together hold the majority of the world’s known lithium resource – boost their production. Chile alone is currently responsible for a quarter of world production but holds almost 10% of the world’s resource. Next in terms of resources is Bolivia with 24% of the world’s known lithium reserves, and Argentina with 21%, though neither yet contribute significantly to global production.

TOWARDS NET ZERO

Since signing the Paris Agreement, how are countries performing on their climate pledges? Towards Net Zero analyses countries’ progress and major climate challenges, and their lessons for the rest of the world in cutting emissions.

With all these countries looking to develop their lithium industries, the world faces two very different choices about where it sources the critical mineral: from hard rock, as in Australia, or from salt-rich groundwater as in Chile. (See how lithium mining has transformed the landscape in Chile.)

“If you’re talking about hard-rock lithium mining, the environmental impact is pretty much the same as any other comparable mining operation,” Gavin Mudd says. “Brine is radically different.”

Mudd is an associate professor with Melbourne’s RMIT University and the chair of the Mineral Policy Institute, an independent organisation that monitors Australia’s mining industry. He says misinformation and confusion about lithium mining is common. For example, he says the idea that lithium was a scarce resource has been disproven but continues to linger. “Lithium is actually a very common mineral,” says Mudd. “It’s found all over the place but historically we haven’t worried about mining it.”

Lithium has proved a crucial metal for use in batteries for electric vehicles (Credit: Getty Images)

When it comes to the environmental impact of lithium mining in Australia, he says people often confuse the situation with what occurs in South America.

The difference starts with the underlying geology. In younger landscapes like South America, lithium is found at the bottom of crusted salt lakes at high altitudes. Australia, meanwhile, is a more ancient geology. Lithium-bearing pegmatite deposits are found across the county, in chunks of landmass that collided over hundreds of millennia to form the continent of Australia. These regions include the Pilbara and Yilgarn cratons (continental rocks that have been stable for over a billion years) in Western Australia, Pine Creek Province in the Northern Territory, the Georgetown region in Queensland and central Victoria.

The refining process carries environmental risks as its energy and chemically intensive, however Allison Britt, director of minerals advice with the government agency Geoscience Australia, says the process of extracting lithium in Australia is not much different to other forms of metals mining. When an economically viable resource is identified, the surface is cleared, the earth is scraped away, the rock blasted and the rubble hauled off for processing into concentrate.

“Each hard rock deposit is its own unique beast,” Britt says. “At a higher-grade deposit, you dig up less rock compared to lithium produced.”

In South America the process is more like playing with a big, fiddly chemistry set. As the lithium lies at the bottom of a salt lake, it is usually mixed with a range of other minerals. Getting it out requires pumping brine out from beneath the bottom of a salt lake into a pit and then waiting for the water to evaporate in the sunlight until lithium concentrations reach 6,000 parts per million. It is a thirsty process – requiring roughly 1.9m litres (418,000 gallons) of water to produce one tonne (2,204lbs) of lithium produced, all of it lost to evaporation – that always carries the risk of leaks and spills.

We know we need to decarbonise as soon as possible and critical minerals like lithium and a whole heap of others are part of that pathway. But we also know the mining of those minerals is environmentally destructive – Maggie Wood

From there the lithium – in both regions – must be processed further to make it useful. The lithium carbonate pulled out of Chilean brine ponds needs more work to become lithium hydroxide, the preferred material of battery manufacturers.

The rock dug out of the ground in Australia has to be crushed and roasted to produce spodumene. This material, which contains about 6% lithium, is then shipped from Australia to China, which refines 60% of the world’s lithium and 80% of the world’s lithium hydroxide – though this may be changing. As part of an effort to diversify the supply chain, the Western Australian state government is working to build local refining facilities close to its own lithium mines.

The price of lithium leapt in 2021 and 2022 – and the demand for the metal is predicted to remain high for decades (Credit: BBC. Source: Benchmark Minerals)

There are three proposals for new lithium refining facilities in development around Australia. These plants will bring their own environmental challenges. Roasting spodumene to create a concentrate requires significant amounts of energy and large quantities of sulphuric acid. At the end, the slag waste will also have to be disposed of – a process that will need to be monitored to avoid causing pollution.

It is still early days for the Australian lithium mining industry but Maggie Wood, executive director of the Conversation Council of Western Australia, a not-for-profit organisation that represents more than 100 environmental groups across Western Australia, says the industry is being closely watched.

“On the one hand, we know we need to decarbonise as soon as possible and critical minerals like lithium and a whole heap of others are part of that pathway,” Wood says. “But we also know the mining of those minerals is environmentally destructive.”

For example, environmentalists have raised concerns that sediment from the Finniss Lithium Project mine may have contaminated a nearby creek. BBC Future Planet contacted Core Lithium, the owners of the Finniss Lithium Project, to respond to these claims but received no reply.

Kirsty Howey, co-director of the Northern Territory Environment Centre, an environmental body within the Territory, says she is worried the cumulative environmental impact from multiple mines opening to extract lithium deposits between Darwin and the famous Litchfield National Park, an hour’s drive south of the city.

“There are lithium tenements all the way across it,” Howey says. “You’ve got these vast areas of the Territory that are pretty pristine by global standards and they’re now subject to [permits for future lithium mining].

“It’s a tropical ecosystem, so you’ve got increased cyclone risk, you’ve got huge rains – rain is the enemy of mining. That’s when metals drain into waterways and cause havoc.

“We’ve got to stop fossil fuel development, but we also need the scrutiny on mining.”

BBC Future Planet contacted the Minerals Council of Australia, a representative body for the country’s mining industry, for comment on the concerns raised about the impacts of lithium mining, but they did not respond by publication.

Some of Australia’s political leaders have argued that acquiring metals for decarbonisation is the priority. In early October, when the Finniss Lithium Project broke ground 80km (50 miles) from Darwin, the Northern Territory’s Mining and Industry Minister Nicole Manison was on site. Speaking to the media, she said: “We have to be realistic about that transition – there are materials you absolutely must mine to achieve decarbonisation and tackle climate change head-on, and many of those materials are available in the Northern Territory.”

Australia is not the only country with huge reserves of lithium – Chile is thought to hold even more (Credit: BBC. Source: US Geological Survey)

The issues with lithium mining in Australia are no different to those experienced in the industry more broadly: open-cut mining carves deep scars in the landscape, often within ecosystems that are already under pressure. Dust from mining operations can be whipped up where it can contaminate waterways or blow into towns where people can inhale it. Heavy rain can dislodge minerals and wash them into nearby rivers or cause them to seep into groundwater. When a mine closes, rehabilitation works may not have been properly budgeted for, or its operators simply disappear into the night.

RMIT University’s Gavin Mudd says these problems can be managed – some estimates suggest hard-rock lithium mining will be responsible for 10 million tonnes of CO2 emissions by 2030, but refineries can be built close to the source of extraction rather than shipping overseas, to reduce some of the emissions from transportation. Meanwhile in Canada, a gold mine has shown that mining equipment can be electrified and renewable energy can be used to power their systems to reduce CO2 emissions.

Mudd also notes lithium is not likely to be mined as intensively in Australia and, counterintuitively, may result in a net reduction in mining overall as the need for coal dwindles. “In Australia we’re mining something in the order of five to eight billion tonnes [of waste rock] a year just to get our coal,” he says. “People aren’t factoring in that if we delete coal out of the equation – that’s huge.

“To me, it’s all very hopeful. There’s still issues with the way we do things but that’s not a problem with lithium, that’s a problem with the way we regulate mining.”

Another way to reduce these impacts further is to blunt demand for new lithium mines by boosting recycling rates. Today, Australia currently only recycles 10% of its lithium-ion battery waste. Libby Chaplin, chief executive officer of the Battery Stewardship Council (BSC), an organisation created to oversee the recycling of used batteries where it would otherwise be too costly for private industry to handle, says recycling will become a pressing issue by the end of the decade as electric vehicle batteries begin to reach end-of-life. (Read more about the challenges of recycling lithium batteries.)

“If we don’t address this, we will, within a not-too-distant future, have a very large battery waste problem and stockpiles of lithium EV batteries,” Chaplin says. “That’s the last thing we want because storing electric vehicle batteries can be problematic.”

By starting small now Chaplin says Australia can build the proper infrastructure to stop this from becoming a problem, particularly as distance is a challenge. Having to collect, transport and sort materials from across a country that spans a continent is difficult and expensive but Australia has good examples to follow. Chaplin points to its system for recycling lead-acid car batteries – widely considered a success – to show how it can be done.

CARBON COUNT

The emissions from travel it took to report this story were 0kg CO2. The digital emissions from this story are an estimated 1.2g to 3.6g CO2 per page view. Find out more about how we calculated this figure here.

There are already steps being taken in this direction. In January 2022, the BSC introduced a levy scheme in partnership with battery manufacturers that has lifted the recovery rate of small batteries covered by the scheme from less than 8% to over 16% in six months. For each battery imported, participating manufacturers pay 4 Australian cents (2p/3 US cents) per equivalent battery unit (24g/0.8 ounces) into a fund that covers the cost of transport from collection sites across the country to recycling centres. This programme is not exclusively focused on lithium-ion batteries, but it shows huge gains can be made quickly.

Some question whether a large-scale lithium recycling industry is possible but Chaplin believes it is. Lithium only makes up 1% of an electric car battery but the majority of the materials – steel, plastic, aluminium and copper – are recoverable. The rest – so-called “black mass”, which includes lithium, graphite and cobalt – is more difficult but can still be recovered. Of these materials, Chaplin says priority should be given to recovering cobalt, as it is the most environmentally destructive metal to mine. Around 70% of the world’s production currently originates in the Democratic Republic of Congo.

It is thought recovering this “lost value” could be worth up to $3.1bn (£2.8bn) . The European Union, which introduced a battery directive requiring manufacturers to blend at least 4% recycled lithium into new batteries, has shown how regulation may help.

Chaplin agrees that better recycling of lithium batteries is necessary to minimise the demand for more extraction. “We can’t be having a conversation about lithium or climate change without having the conversation of making sure these batteries are recovered at end of life,” she says. “Once extracted, we have an obligation to keep it going.”