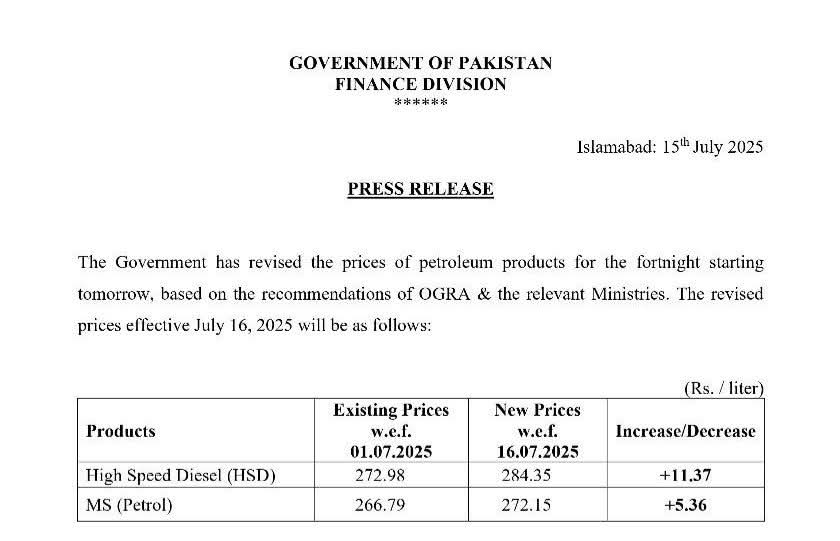

The federal government on Tuesday hiked the price of petrol by Rs5.36 per litre and that of high-speed diesel (HSD) by Rs11.37 for the next fortnight.

A press release from the Finance Division said the revised prices were based on recommendations by Ogra and concerned ministries.

The new petrol price is Rs272.15 per litre and Rs284.35 for HSD.

The press release did not mention any changes in the prices of kerosene and light diesel oil.

According to informed sources, the ex-depot price of petrol was projected to rise by about two per cent to Rs272.04 per litre, while HSD was likely to see a 2.5pc increase to approximately Rs279.48 per litre.

Widely used in motorcycles, rickshaws, and private vehicles, petrol has a direct impact on the budgets of middle- and lower-income households.

Diesel fuels heavy transport, agricultural machinery, and trains. Its price is considered highly inflationary, influencing the cost of food and other essential goods. Transporters had already begun adjusting fares in anticipation of the expected increase.

Despite zero general sales tax (GST) on petroleum products, the government is currently collecting close to Rs98 per litre in total levies on both petrol and diesel. This includes a petroleum development levy (PDL) of Rs78.02 on petrol and Rs77.01 on diesel and HOBC, along with a Rs2.25 per litre climate support levy (CSL). Additionally, a customs duty of Rs20-21 per litre is levied on both fuels, whether imported or locally refined.

Oil marketing companies and dealers are earning around Rs17 per litre as combined distribution and retail margins.

Petrol and diesel remain the primary drivers of fuel consumption, with monthly sales between 700,000 and 800,000 tonnes, compared to just 10,000 tonnes of kerosene.

In FY24, the government collected Rs1.161 trillion through the petroleum levy and aims to increase this by 27pc to Rs1.470tr in FY25. Despite zero GST, petroleum products continue to serve as a significant source of revenue.