Global oil markets may face a “super glut” next year as a sharp rise in supply converges with weakening economic conditions, Trafigura has cautioned, according to the Financial Times. Saad Rahim, the commodity trading giant’s chief economist, said new drilling projects and slowing demand growth are set to put further downward pressure on already subdued crude prices.

Brent crude has dropped 16% this year—its steepest decline since 2020—with additional supply from major projects in Brazil and Guyana expected to deepen the slump in 2025. “Whether it’s a glut or a super glut, it’s hard to get away from that,” Rahim said, noting that China’s strong buying activity remains crucial to delaying the oversupply.

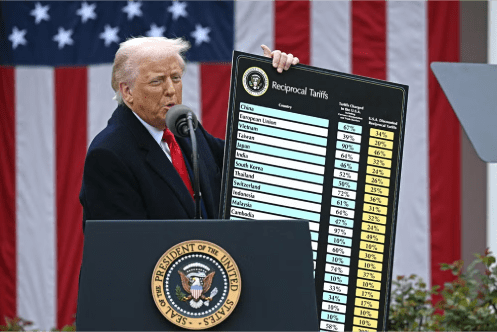

Trafigura reported net profits of $2.7 billion for the fiscal year ending September, slightly below last year’s $2.8 billion and marking a five-year low after elevated earnings driven by geopolitical disruptions following Russia’s invasion of Ukraine. Its metals division, however, posted a record year, benefiting from copper shipments to the U.S. amid tariff-related volatility.

CEO Richard Holtum highlighted that headline-driven volatility shaped markets throughout the year and is likely to persist into 2026. Despite resilient trading performance across divisions, group equity slipped to $16.2 billion from $16.3 billion, the first decline in nearly a decade—partly due to rising payouts to employee-shareholders. Total payouts increased to $2.9 billion, up from $2 billion a year earlier, putting pressure on Trafigura’s dividend programme amid a notable wave of senior staff departures.

Ben Luckock, Trafigura’s head of oil trading, previously forecast that crude prices could dip below $60 per barrel, predicting they may fall into the $50s over Christmas and the New Year before any recovery.