After a torrid run, oil has barely managed to squeak out a second week of gains in a volatile session as risk-off sentiment spreads in broader markets. Predictably, the bears have started coming out of the woods, with Citigroup recently predicting an oil price crash to $65 this year. But luckily for the oil bulls, there’s no shortage of positive catalysts in this market. Stewart Glickman, energy equity analyst at CFRA Research in New York, says traders are now seeking refuge in commodities, including oil, as a hedge against inflation.…

Read MoreCategory: Highlights

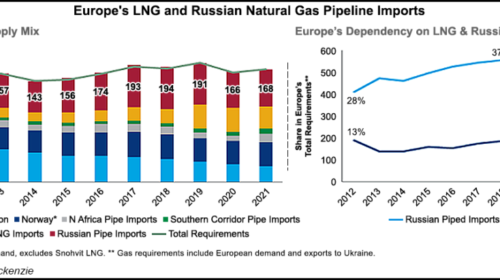

Threat of Russian Attack on Ukraine Looms Over Energy Markets – LNG Recap

The growing threat of a Russian invasion of Ukraine had the energy market on edge Monday, when oil and natural gas prices again moved higher. The standoff has also upended metals markets, weighed on equities and is creating additional inflationary pressures. The U.S. warned Friday that an attack could be imminent, sending commodity prices up. German Chancellor Olaf Scholz was scheduled to speak with Russian President Vladimir Putin in Moscow on Tuesday in the latest diplomatic push to ease tensions. Spot liquefied natural gas (LNG) prices in Asia followed European…

Read MoreCarrying the energy of the future

Heinz-Jürgen Hiller, Business Development LNG at VTG Rail Europe, looks at LNG transportation by rail and the important role it could play in the future of the LNG industry. In April 2021, the European Parliament and the Council of the EU agreed on a new European climate law and substantially raised the EU’s greenhouse gas (GHG) reduction target for 2030. At the same time, GHG neutrality by 2050 – which is at the heart of the Green Deal – was for the first time anchored in law at an EU…

Read MoreHow Long Will High Oil Prices Last?

The price of West Texas Intermediate (WTI) opened 2022 at about $75 a barrel (bbl). Last week, the price rose above $90/bbl for the first time since 2014. That was also the last year the price of WTI was above $100/bbl. To recap, in the first half of 2014, oil prices spent most of the time bouncing between $100/bbl and $105/bbl. But the shale boom had put millions of new barrels of oil into the markets over the course of several years, and by mid-2014 the market was approaching an…

Read MoreOil majors face backlash as era of big profits returns

PARIS: Soaring energy prices have brought massive profits to oil majors – along with fierce criticism from environmentalists and politicians at a time when consumers are left with rising bills. US firm ExxonMobil, France’s TotalEnergies, and UK giants Shell and BP announced in the past week 2021 profits totalling US$66.7 billion. It marked a huge turnaround from 2020, when they posted losses as the pandemic emerged, prompting lockdowns that brought the world economy to a grinding halt and caused crude prices to collapse. But oil and gas prices rallied big…

Read More